The key things you need to know about the claim notification form for R&D Tax Relief.

If your company has never claimed R&D Tax Credits before or has not claimed in the last 3 years, you may need to submit a claim notification form (CNF) before you file your claim. This applies to accounting periods starting on or after 1 April 2023.

In this blog, I have explained the key things you need to know about the claim notification form, including:

- Who has to submit a CNF

- What information you need to provide

- What happens if you miss the deadline

If you have any questions about the form or would like support on your upcoming R&D Tax claim from a trusted consultant, please get in touch. My colleagues and I in GrantTree’s R&D Tax Relief team would be happy to help.

2 October at 12 pm

Become a claim notification expert

Join our free webinar and learn how to be fully compliant with the claim notification form. Our R&D Tax experts will cover:

- Whether you need to file this form

- Step-by-step guidance on completing the form

- How to stay compliant and avoid HMRC pitfalls

- Your questions in our detailed Q&A

Do I have to submit a claim notification form?

Find out if you need to file a claim notification form in under 30 seconds with our free checker.

When did the accounting period you're claiming for start?

This requirement only applies to accounting periods beginning on or after 1 April 2023.

Are you filing your claim within 6 months of the end of the accounting period?

Have you claimed R&D Tax Relief before?

Did you file within the last three years?

This refers to the 3-year window ending 6 months after the end of the accounting period in which the R&D took place.

Did you file by amending your company tax return?

When did you file the amended return?

Here is some extra context on each of the questions we ask in the checker.

Question 1: When did your accounting period start?

As I mentioned in the introduction, this requirement only applies to accounting periods starting on or after 1 April 2023.

If the development work you’re looking to claim for took place in an accounting period starting on or after 1 April 2023, go to question 2.

If not, you don’t need to submit a claim notification form.

Question 2: Are you filing for R&D Tax Relief before the 6 month claim notification deadline?

If your answer is ‘yes’, you don’t need to file a claim notification form.

The claim notification requirement only applies to companies filing for R&D Tax Relief more than 6 months after the end of the accounting period in which the relevant R&D took place.

So, for example, if your R&D occurred in an accounting period ending 31 December 2024, you don’t need to pre-notify HMRC if you file for R&D Tax Relief before 30 June 2025.

If you are filing for R&D Tax Relief after the claim notification period (more than 6 months after the end of your accounting period), move to question 3.

Question 3: Have you claimed R&D Tax Relief before?

If you have not claimed R&D Tax Relief before, and you are planning to file for R&D Tax Relief more than 6 months after the end of the relevant accounting period, you will need to file a claim notification form.

Claimed before? Move on to question 4.

Question 4: Did you file within the last 3 years?

When was the last time you filed for R&D Tax Relief?

If it was more than 3 years before your claim notification form deadline, you will need to file a claim notification form.

It can get confusing, so let me clarify. The 3-year window we’re talking about ends 6 months after the end of the accounting period in which the R&D you’re claiming for took place.

For example, if your accounting period ended on 31 December 2024, the window would end on 30 June 2025 and start on 30 June 2022.

This window is called the exemption period. If you last filed for R&D Tax Relief within the exemption period, move on to question 5.

Question 5: Did you file by amending your company tax return?

For the purposes of the claim notification form, R&D Tax Relief claims made with your original company tax return are treated differently from claims made by amending your return after you’ve filed it.

If you filed for R&D Tax Relief with your company tax return, and it was during the 3-year exemption period described in question 4, you don’t need to file a claim notification form.

This is true even if you are filing for R&D Tax Relief more than 6 months after the end of the accounting period that contains the R&D you’re claiming for.

However, if you only ever filed for R&D Tax Relief by amending your company tax return once it has been submitted, the question becomes this: ‘When did you file the amended return?’

Question 6: When did you file the amended return, and what was the start date of the accounting period it related to?

If you claimed R&D Tax Relief by filing an amendment to your company tax return after 1 April 2023, and this previously submitted tax return was for a period beginning before that date, then, for the purposes of the claim notification form, it does not count as you having filed for R&D Tax Relief.

As a result, you will need to submit a claim notification form, bearing in mind the information in questions 1-5.

If you submitted your amendment before 1 April 2023, and within the 3-year window described in question 4, or if the amendment was for a period beginning on or after 1 April 2023, then you won’t need to submit a CNF.

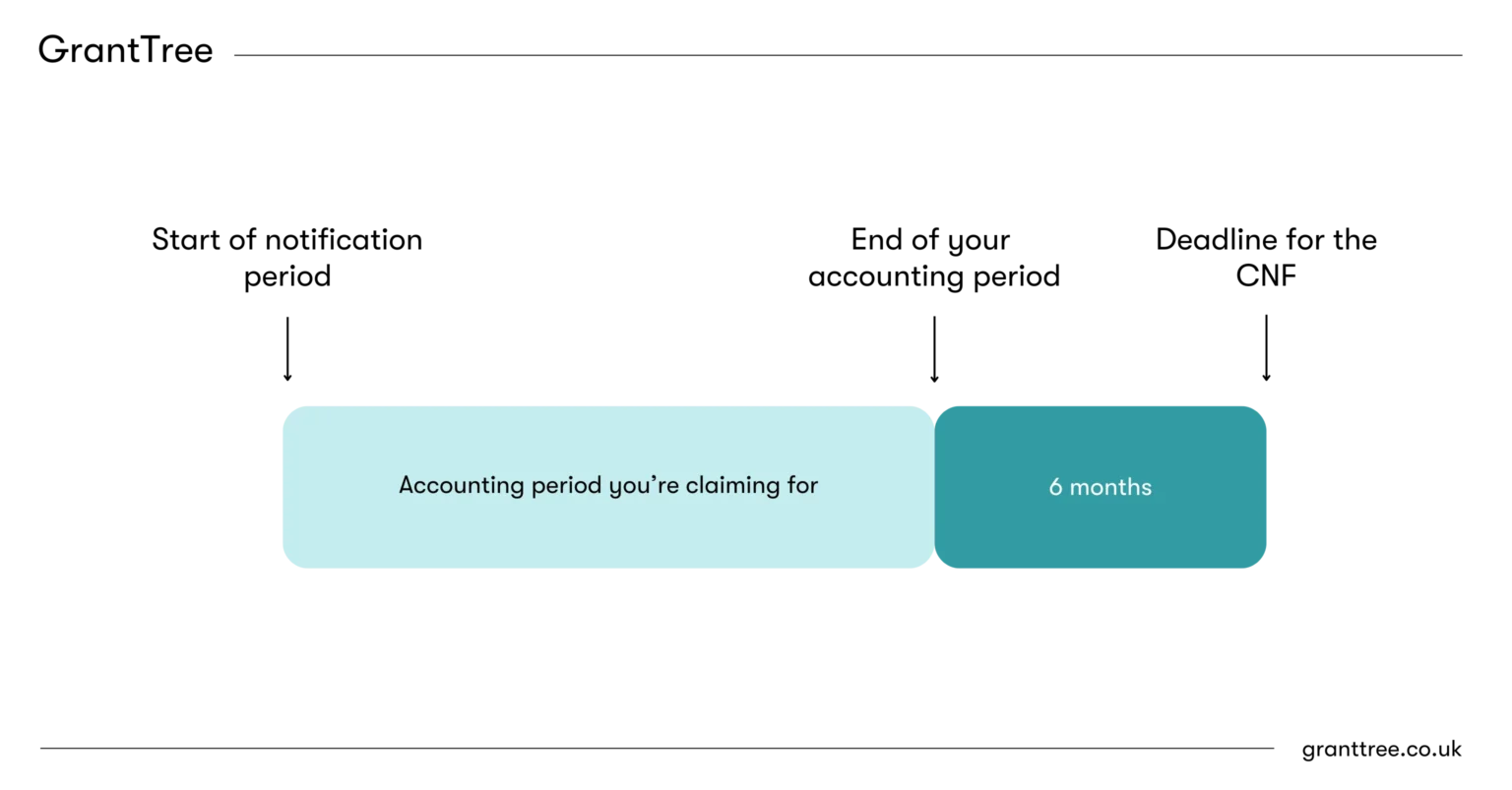

What is the deadline for the claim notification form?

The deadline for submitting the claim notification form is 6 months after the end of the accounting period you’re claiming for.

So, if you were claiming for work conducted in an accounting period ending 31 December 2024, you would have until 30 June 2025 to file your CNF.

Claiming for two accounting periods? The deadline is 6 months after the end of the second accounting period in your claim.

This deadline is separate from the overall deadline for submitting an R&D Tax claim. That is two years after the end of the relevant accounting period.

What information do I need to submit in the claim notification form?

You will need to submit the following information on your claim notification form:

- Your company’s Unique Taxpayer Reference (UTR)

- The name of the main internal contact who is responsible for your R&D claim

- The contact details of any agent involved in your R&D Tax claim, such as an R&D Tax Relief consultant

- The start and end dates of the accounting period you’re claiming for

- A high-level summary of your planned activities

You don’t need to include evidence to prove these activities met the definition of qualifying R&D on your form. However, you will need to do this in your additional information form (AIF) when you submit your claim.

How do I submit a claim notification form?

You submit your claim notification form through this government page.

Who can submit the claim notification form?

The following people can submit a claim notification form on behalf of your company:

- A representative of your company

- An agent acting on your behalf of your company, such as an R&D Tax Relief consultant

What happens if I miss the deadline for the claim notification form?

If you miss the claim notification form deadline, you probably won’t be able to claim R&D Tax Relief for that accounting period.

HMRC deals with late claims in accordance with its Statement of Practice 5 (2001).

The statement says, “the time limits allowed for making claims[…]should generally be adequate, and the Commissioners for HMRC will not make routine use of their powers to accept claims made outside these limits.”

Translation: HMRC is unlikely to accept your form if you submit it after the deadline.

HMRC can make an exception if you submitted the form late for reasons beyond your company’s control. For example, the person responsible for submitting your form was ill.

However, such exceptions are made on a case-by-case basis. The most likely outcome is that you won’t be able to claim R&D Tax Relief.

Claim notification form amnesty

On 28 April, HMRC announced it will accept R&D Tax Relief claims from companies that missed the deadline for submitting a claim notification form if:

- The deadline for their CNF - i.e. the end of their 6-month claim notification period - fell between 8 September 2024 and 30 November 2024

- They submitted a compliant R&D Tax Relief claim via amended company tax return between 1 April 2024 and 30 November 2024 for an accounting period beginning before 1 April 2023

Companies that qualify for this amnesty must contact HMRC’s R&D policy team, either directly or through their R&D Tax Relief consultant, before making their claim.

HMRC is doing this to make up for publishing incorrect guidance on the CNF. The guidance was live on the government’s website between 8 September and 30 November 2024 and was repeated in a meeting of the R&D Communications Forum (RDCF).

Get help from our R&D Tax Relief experts

Looking for help preparing and submitting the claim notification form? Or wondering what to do if you’ve missed the submission deadline?

GrantTree’s R&D Tax Relief experts are here to help. With more than 14 years of experience filing compliant claims and over £450 million secured for our clients, our team are perfectly placed to help you navigate this major change to the scheme.

Just get in touch, and one of our team will be right with you.

Frequently asked questions about R&D claim notification

R&D notification (also called claim notification or pre-notification) is the form some companies must submit to HMRC before claiming R&D Tax Relief.

The deadline for submitting R&D claim notification is six months after the end of the accounting period in which the R&D you’re looking to claim for took place.

Whether you need to complete R&D notification depends on several factors, such as whether you’ve claimed before, when you are filing, and how you submitted your last claim.

The claim notification period is six months after the end of the accounting period in which your R&D took place.

For example, if your accounting period ended on 31 March 2025, you would need to file your claim notification form by 30 September 2025.

That’s assuming your company needs to file a claim notification form.

The claim notification period is six months after the end of the accounting period in which your R&D took place.

For example, if your accounting period ended on 31 March 2025, you would need to file your claim notification by 30 September 2025.

The claim notification period only applies to certain companies, though.

The notification condition requires some companies to tell HMRC they plan to claim R&D Tax Relief before they file.

To satisfy this condition, you must file a claim notification form within six months of the end of the accounting period in which your qualifying R&D took place.

Note: not all companies claiming R&D Tax Relief are subject to the notification condition.

HMRC introduced the claim notification requirement for accounting periods starting on or after 1 April 2023.

If your R&D took place in an accounting period starting on or after this date, you may need to file a claim notification form.

Whether you have to pre-notify HMRC that you’ll be claiming R&D Tax Relief depends on:

- Whether you’ve claimed before

- When you last filed

- How you submitted your claim

- When the accounting period of your previous claims started

Not all companies need to pre-notify HMRC that they are planning to claim R&D Tax Relief. However, this requirement does apply to many businesses.

You only need to pre-notify HMRC if you are submitting your claim later than six months after the end of the relevant accounting period.

Assuming this is the case, you will need to pre-notify HMRC if you have not claimed R&D Tax Relief before.

Otherwise, your need to pre-notify depends on things like when you last filed, how you submitted your claim, what accounting period you’re claiming for, and when the accounting period of your previous claims started.

Not necessarily. If you are claiming R&D Tax Relief for the first time, you only need to notify HMRC ahead of time – by submitting a claim notification form – if you are filing later than six months after the end of the accounting period you’re claiming for.

So, if your accounting period ended 31 March 2025, you would only need to notify HMRC if you were going to file your claim after 30 September 2025.

If you have claimed R&D Tax Relief in the last three years, you may be eligible for the pre-notification exemption.

The exemption applies if you have filed in the last three years, unless:

- HMRC rejected your claim

- You claimed R&D Tax Relief for a period starting before 1 April 2023 by amending your tax return, and that amendment was received on or after 1 April 2023

This three-year window runs from 18 months before the start of the accounting period you’re claiming for until six months after it ends.

So, if your accounting period ran from 1 January to 31 December 2025, the three-year window would span 1 June 2023 to 30 June 2026.

No, claim notification isn’t part of your CT600. You submit a claim notification through this online form.

You must submit this form within six months of the end of the accounting period in which the R&D you’re claiming for took place.

Yes, your claim notification form can be submitted by either:

- A representative of your company

- An agent acting on your company’s behalf, such as an R&D Tax Relief provider

No, you don’t need to wait for HMRC’s confirmation before filing your R&D Tax Relief claim. Once you’ve filed your claim notification form, assuming it’s complete and accurate, you will have fulfilled the pre-notification requirement and are free to prepare your claim.