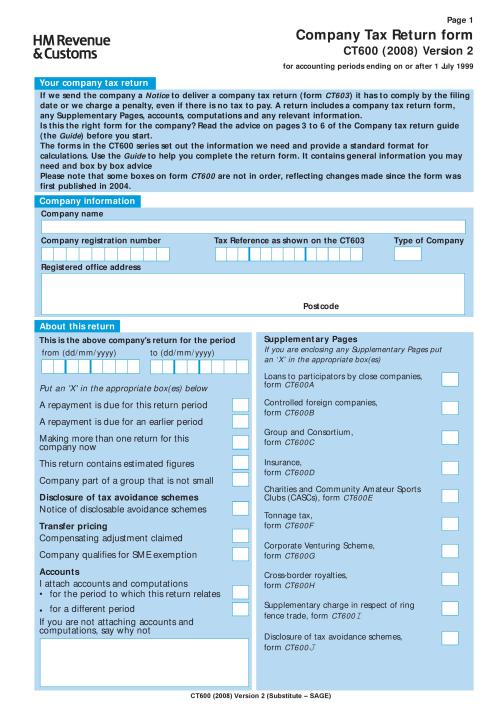

Sample CT600:

It is essential to know exactly how and where to put your R&D claim figure in a tax return. Otherwise, it will impact on your entire claim document, often resulting in an HMRC enquiry to get to the bottom of why they perceive your calculations as incorrect.

Obviously, this is not ideal since HMRC enquiries can be long and painful, and cost a lot of effort to resolve.

Before you begin: the first amendment

When you file a claim, you need to submit the claim document with both technical and financial sections, plus the tax return, which consists of a CT600 and tax computations.

In the 12 years we have been operating, we have identified that the best way to ensure your claim speeds through HMRC without an enquiry is to file your accounts and tax return as normal (without the R&D claim amount) and then file an amended tax return (link to R&D Tax Credits: filing with an amendment versus filing with the original tax return) directly with an HMRC specialist R&D unit which includes the R&D claim amount.

The reason for this is that it ensures that the claim is seen by a specialist who knows about R&D Tax Credits. In our experience, when the claim is submitted to the central tax office, it occasionally gets picked up by an HMRC inspector who is not familiar with R&D Tax Credits. If that happens, they see it as an opportunity to learn R&D Tax Credits (at your cost!), and not only are they guaranteed to have questions (thus causing delays), but those are likely to be fairly nonsensical questions that an experienced R&D inspector would never ask.

This article will outline the steps necessary to include your R&D claim figure and is written with the assumption that you are using this process of filing an amendment and that you are working from your already-filed CT600.

The starting line: which software to use

We cannot provide comprehensive documentation for how to do this in all the numerous software packages that can be used to create a CT600. Internally, we use something called TaxFiler.

It should be relatively easy to adapt the instructions to another software package, so long as the system supports R&D Tax Credits claims and your tax computations are not too complex.

As usual, if your tax computations are too complex to do this easily, we recommend that you use a specialist or at least get your accountant involved. It’s important to get this right, as HMRC can apply penalties if mistakes are made.

Once the CT600 has been set up in TaxFiler, the following steps are necessary to add in the R&D Tax Credits claim:

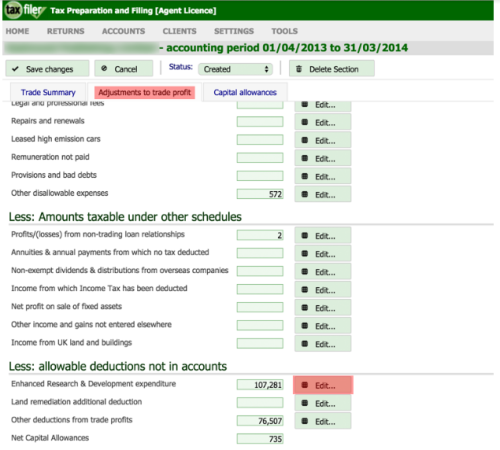

Adjust Trading Profits

First, before adding the R&D section, you should go into your existing “Trading Profits” section and add the R&D Expenditure there. After you’ve created your CT600 and set it up to reflect your pre-claim tax computations, go into Data Input and click on the Trading Profits section.

Within Trading Profits, click on the “Adjustments to trade profit” tab and then scroll down to the “Enhanced Research & Development expenditure” section and click on Edit:

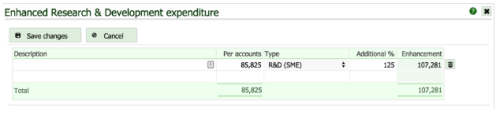

Finally, set the correct enhanced expenditure and enhancement amount:

Add “Research & Development Tax Credit” section

Go back to the Data Input section and Add a new section for Research and Development Tax Credit:

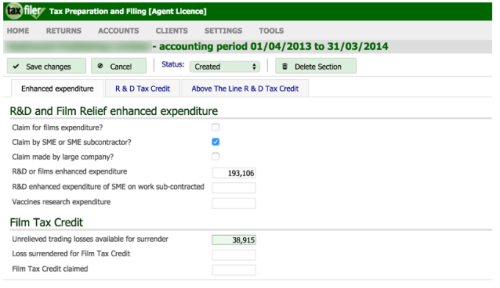

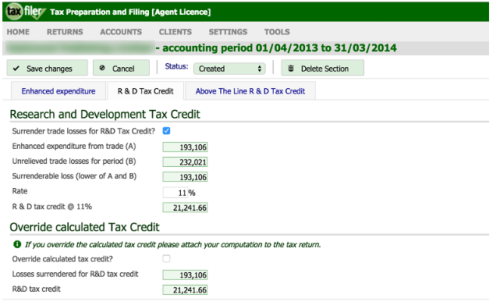

And similarly set the second tab data. Many sections are auto-calculated but you can override the calculations in some cases (particularly if there are rounding issues).

That’s it! Your CT600 is now correctly amended. Don’t forget to attach the tax computations and the Technical Narrative (including the calculations table explaining how you arrived at the total R&D figure) when emailing the specialist unit, or else, once again, you risk delays and extra scrutiny.

Hopefully, this article has provided you with enough information about how and why we file an amendment this way, and how to do it yourself. We find it helps claims get to where they need to be and get back to you again in the fastest possible way.

Of course, the tax return document needs to be 100% accurate and reflect the tax position of the company at the time of filing so if you need any guidance or advice, please get in touch and we will help you with the best way to move forward.