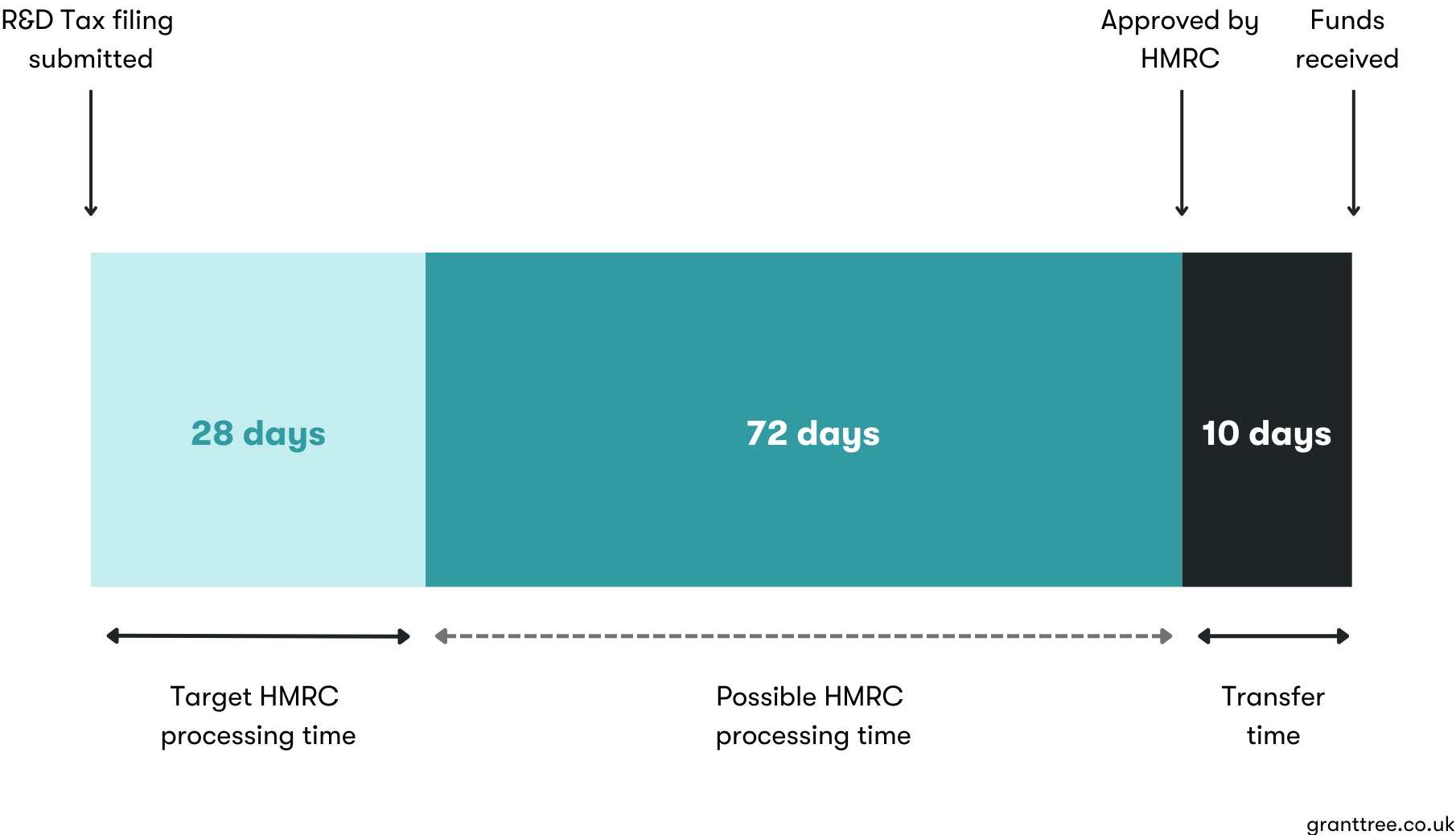

HMRC aims to process the majority of claims within 28 days. However, it can take up to 100 days to get your money.

HMRC says it aims to process 95% of R&D Tax Credits claims within 28 days. But, processing times can range from anywhere from 28 and 90 days.

It then takes another five to ten days for the money to be transferred into your account.

In total, it can take up to 100 days to receive your funding.

R&D Tax Credits processing times

As you can see, the processing times for R&D Tax Credits claims can vary significantly, depending on things like the time of year and the complexity of your claim.

What affects HMRC's processing times?

Here are the main factors that can influence how long it will take for you to receive your R&D Tax Relief.

HMRC's capacity

As the UK’s national tax and customs agency, HMRC has only so many people and resources to dedicate to processing claims. Backlogs can quickly form especially during busy periods.

Also, as HMRC highlights in its annual report, the total number of R&D Tax claims is increasing. This is putting more strain on the organisation and contributing to increasing turnaround times.

It’s also possible that processing times will increase now that every claim will include much more technical and financial information, due to the mandatory additional information form which became a requirement for all claims filed after 8 August 2023.

The time of year

Many companies have their financial year-ends between December and March, meaning HMRC has many more applications to process.

If you file during these months – the spring slog, as we sometimes call it – you will probably have to wait longer to receive your funding. Up to three months, in our experience.

Periods of increased scrutiny

Both the government and HMRC have become increasingly concerned with unscrupulous R&D Tax Credits providers. These firms either unknowingly or even willingly submit claims that are either too large or completely invalid on behalf of unsuspecting clients.

These agencies have made HMRC much more suspicious of claims generally, leading to a surge in enquiries as well as periods of increased scrutiny where filings take longer to process.

The complexity of your claim

Your application can also take longer to process if your business and/or your R&D Tax Credits claim are particularly complex. For example, if you are claiming on behalf of a group.

For this reason, it usually takes HMRC more time to process claims from larger companies, like those applying for the Research and Development expenditure credit (RDEC).

Access your R&D Tax Credits now

In summary, you could be waiting a while for your R&D Tax Credits. But through GrantTree’s R&D Advance Funding service, we could advance you up to 80% of your claim size up to six months before your filing date.

That means you could get your money almost a year ahead of schedule.

Through Advance Funding, you could accelerate your investments in staff and equipment and bring your product or service to market sooner.