R&D Tax Credits for SMEs work by “enhancing” part of the R&D expenditure. What this means is that instead of 100% (the normal amount) being deducted from the turnover to calculate the profit, a higher percentage is deducted.

This means that if, for example, you had £200k of turnover, and £100k of expenditure, all of which was R&D, and therefore your initial position was £100k of profit (which would lead to £20k of Corporation Tax at 20%), if the expenditure was enhanced by 50%, you would deduct another £50k, leading to only £50k of profit and only £10k of Corporation Tax – i.e. a £10k reduction in your tax payable.

The situation is somewhat different if you’re making a tax loss, or if the enhancement takes you into a tax loss, but we’ll get to this in the next section. In this section we’re just calculating the enhancement.

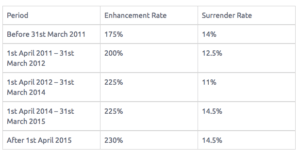

The rate of enhancement depends on the period that you’re looking at. HMRC keeps adjusting this rate, so it is always worth checking what rate actually applies to the period you’re looking at. At the moment, these are the rates since 2007 (ignore the surrender rate for now, we’ll cover it later):

Unless your accounting period exactly matches the tax year, you will have to calculate a prorated enhancement (and surrender) rate for the period. This can be done very simply by prorating based on the months at each period. For example, for an accounting period from October 1st to September 30th, there would be 6 months (October – March) at one rate and another 6 months at the next one. If the period was October 1st 2014 to September 30th 2015, the prorating would be 6 months at 225% and 6 months at 230%, so a prorated enhancement rate of (6 x 225% + 6 x 230%)/12 = 227.5%.

The Enhancement Rate includes both the Qualifying Expenditure and the Enhancement. So if there is a £100k Qualifying Expenditure enhanced at 230%, the actual Enhancement is £130k. The whole £230k sum is referred to as the Enhanced Expenditure. It’s worth paying attention to these terms, as a common mistake can be to use one amount when you were meant to use another.

If, before the R&D claim, the company was showing a tax profit (e.g. £100k), and the enhancement is smaller than that profit (thus not taking the company into a loss), then you’re done with the calculations at this point. Please move on to the CT600 preparation step.

If, however, the company was in a loss before the claim, or if the company is taken into a loss by the application of the enhancement, please proceed to the next section.

Surrender

No, not the white flag type of surrender!

Surrender, in this context, refers to giving up part or all of the loss that’s been generated by the enhancement, in order to get cash right now.

For most businesses, cash in the hand is worth more than cash in the future. However, for years, the R&D Tax Credits scheme only allowed businesses to recover cash if they were profitable (and therefore had taxes to offset). The businesses that most need the help are, of course, those which are not profitable. So, a number of years ago, HMRC introduced the ability for a business that is loss-making and that files for R&D Tax Credits to surrender the loss they’ve generated in exchange for cash on hand.

The way the process works is that if, after the claim has been applied, there is any loss, then part or all of that loss may be surrendered at the “surrender rate” in the table in the previous section.

There are a few restrictions:

The loss that can actually be surrendered is limited by two factors:

The loss that is actually present after the claim is applied: so if the company started with a £50k profit and the enhancement was £75k, the loss after the claim would be £25k, and that is the maximum that could be surrendered.

The “enhanced expenditure” amount. So if the loss was £1m, the R&D expenditure was £100k, and the enhancement for that year was £125k (at 225%), the enhanced expenditure would be £225k, the total loss after claim would be £1.125m, and the part of this that would be surrenderable would be £225k.

It is also worth noting that this cannot be stacked up with loss carried forward from previous years. The R&D Tax Credit is applied before any loss carried forward. So if you started at £100k of profit, and had an enhancement of £150k (so after claim you are at a £50k loss), but also had some loss from previous years of £200k, you could not use that £200k to get yourself to a £250k loss and thereby increase the amount you can surrender.

We know this is complicated to get your head round so if you need to chat through the best course of action, please get in touch.