The first stage of an R&D Tax Credits compliance check or ‘enquiry’ is an initial letter from HMRC. Here’s what that looks like.

HMRC uses different kinds of letters when launching an enquiry into your R&D Tax Credits claim. Some letters are friendly. Others not so much.

For people less familiar with HMRC and its workings, it can be hard to tell the difference.

To dispel that mystery, and ever so slightly lift the curtain on this more challenging aspect of the R&D Tax Credits scheme, here’s an example of a ‘friendly’ enquiry letter you might receive from your tax inspector.

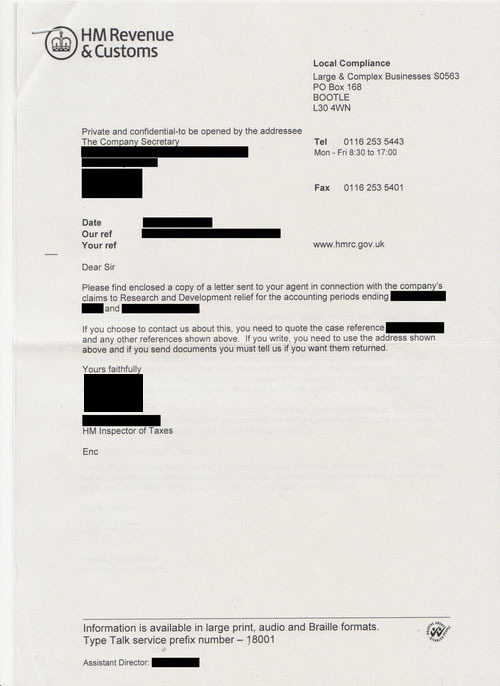

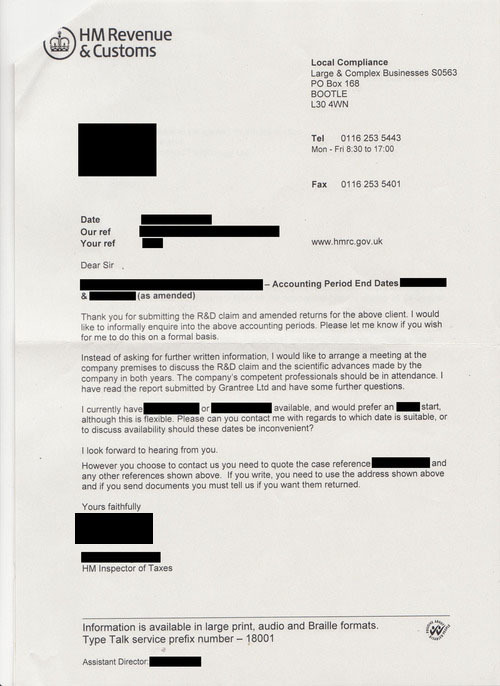

Example of a friendly R&D Tax Credits enquiry letter

Note

Enquiry letter text

Here’s what the text says on these two pages.

Page 1

Dear Sir

Please find enclosed a copy of a letter sent to your agent in connection with the company’s claims to Research and Development relief for the accounting periods ending [date] and [date].

If you choose to contact us about this, you need to quote the case reference [ref] and any other reference shown above. If you write, you need to use the address shown above and if you send documents you must tell us if you want them returned.

Yours faithfully

HM Inspector of Taxes

Page 2

Dear Sir

[ref] – Accounting Period End Dates [date] & [date] (as amended)

Thank you for submitting the R&D claim and amended returns for the above client. I would like to informally enquire into the above accounting periods. Please let me know if you wish form to do this on a formal basis.

Instead of asking for further written information, I would like to arrange a meeting at the company’s premises to discuss the R&D claim and the scientific advances made by the company in both years. The company’s competent professionals should be in attendance. I have read the report submitted by GrantTree Ltd and have some further questions.

I currently have [date] or [date] available, and would prefer an [time] start, although this is flexible. Please can you contact me with regards to which date is suitable, or to discuss availability should these dates be inconvenient?

I look forward to hearing from you.

However you choose to contact us you need to quote the case reference [ref] and any other references shown above. If you write, you need to use the address shown above and if you send documents you must tell us if you want them returned.

Yours faithfully

Why is this a ‘friendly’ enquiry letter?

So what does it mean and what makes it friendly?

The first page can be ignored safely. It is basically HMRC sending you a letter to inform you that they’re sending you a letter. I wish that was exceptional behaviour, but it’s not.

The second page is where the meat is.

Thank you for submitting the R&D claim and amended returns for the above client. I would like to informally enquire into the above accounting periods. Please let me know if you wish form to do this on a formal basis. Instead of asking for further written information, I would like to arrange a meeting at the company’s premises to discuss the R&D claim and the scientific advances made by the company in both years. The company’s competent professionals should be in attendance. I have read the report submitted by GrantTree Ltd and have some further questions.

The enquiry is clearly described as informal. This is a “friendly” data gathering meeting. There is no assumption that your development work doesn’t qualify for relief.

HMRC wants to meet some of the company’s “competent professionals” to form an opinion, based on the impression they get, that this is indeed the right kind of R&D.

Don’t be put off by the mention of “scientific advances” – the R&D scheme does not require groundbreaking scientific advances like inventing a new theory of gravity. The usual criteria for qualifying development work will apply.

What to do before and during the enquiry interview

Although the meeting is friendly, that doesn’t mean you shouldn’t be prepared. Re-read our articles about R&D Tax Credits, and in particular make sure you are clear on what qualifies and what doesn’t qualify, and that everyone in the meeting is clear about it to.

During the meeting, stay calm and cooperative. This is a friendly meeting.

Sometimes, the HMRC inspector may say things that seem outrageous to you (like comparing software development to bricklaying or knitting), but stay calm and realise that HMRC inspectors are not technical experts themselves, so your job is to calmly bring them around to your point of view.

So long as you filed your claim in good faith, and did not deliberately try to mislead HMRC with either your calculations or your description of the technology, the worst that can happen is that they might reject some or all of your costs.

Leave your enquiry to a specialist

Hopefully this blog has shed some light on R&D Tax Credits Enquiries, and on what the first of the process looks like.

While some enquiries are more cordial than others, even ‘friendly’ investigations can be extremely time-consuming and disruptive.

If you want to protect your claim size, minimise disruption to your business, and strengthen your relationship with HMRC, the best thing to do is worth with an R&D Tax Credits expert like GrantTree.

Calling on decades of R&D Tax Credits experience, our dedicated Enquiry Defence team will manage your compliance check from start to finish, ensuring you receive the best outcome and giving you peace of mind when you need it most.

If you would like to learn more about our Enquiry Defence service, or get some specialist advice about your investigation, just get in touch. Our team would be happy to help you.