The key things you need to know about the new claim notification form for R&D Tax claims.

If your company hasn’t claimed R&D Tax Relief before or in the last three years, you may need to submit a claim notification form. You must submit this form before you apply for R&D Tax Relief.

This requirement applies to accounting periods starting on or after 1 April 2023. Its introduction is one of a series of changes made to the scheme in recent years to prevent abuse.

It is separate from the deadline for submitting an R&D Tax claim, which is two years after the end of the accounting period in which the R&D took place.

This blog explains the key things you need to know about the claim notification form, including when you need to submit it, what information you need to provide, and what happens if you miss the deadline.

If you have any questions about the form or would like support on your upcoming R&D Tax claim from a trusted provider, please get in touch. Our R&D Tax experts would be happy to help.

Do I have to submit a claim notification form?

You can work out whether you need to submit a claim notification by answering three questions.

Question 1: When did your accounting period start?

This requirement applies to accounting periods beginning on or after 1 April 2023.

If the development work you’re looking to claim for took place in an accounting period starting on or after 1 April 2023, you may need to submit a claim notification form.

Question 2: Have you claimed R&D Tax Relief before?

If not, you will need to submit a claim notification form.

If yes, move on to question 3.

Question 3: Have you claimed R&D Tax Relief in any of the last three years?

If you made your last claim less than three years before the end of your accounting period, then the three-year exemption applies. This means you won’t need to submit a claim notification form.

Example: if the accounting period you’re applying for ends on 1 April 2024, you will need to have filed a claim after 1 April 2021 to benefit from the three-year exemption.

If you filed your last claim more than three years before this time, you will need to submit a pre-notification form.

When do I need to submit my claim notification form by?

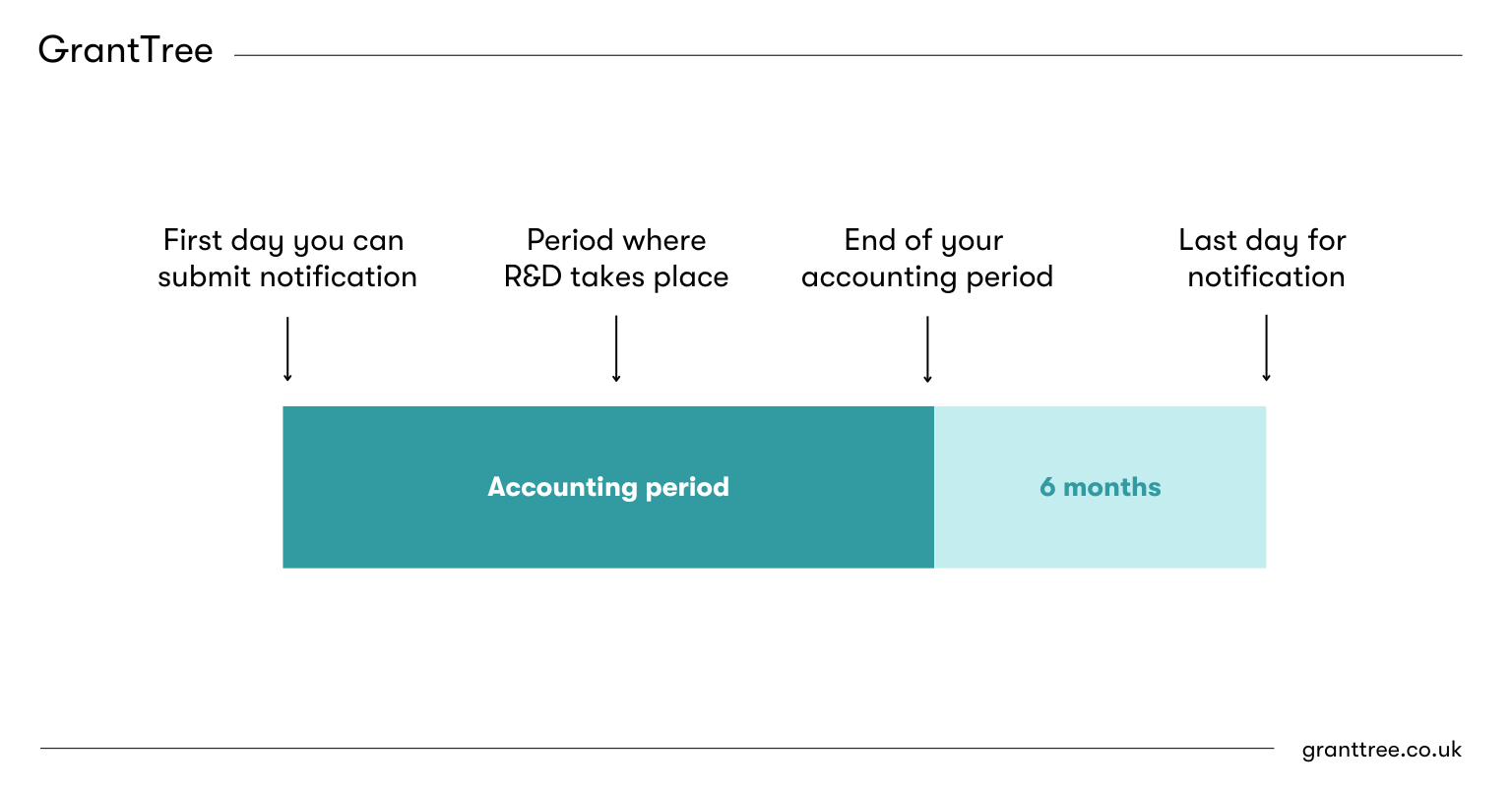

The deadline for submitting the claim notification form is six months after the end of the accounting period you’re claiming for.

So, if you are claiming for work conducted between 1 July 2023 and 30 June 2024, you have until 30 December 2024 to submit the form.

If you are claiming for two accounting periods, the deadline is six months after the end of the second accounting period the claim applies to.

You can submit the form as early as the first day of your accounting period.

So, if your accounting period started on 1 January 2024, that is the earliest you can submit the form.

However, you should only submit the form when you have a concrete idea of what development work you’re planning to undertake. This is because you need to share a high-level summary of your planned activities.

What happens if I miss the deadline?

In short, you probably won’t be able to claim R&D Tax Relief for the relevant accounting period.

HMRC deals with late claims in accordance with Statement of Practice 5 (2001).

The Statement says, “the time limits allowed for making claims[…]should generally be adequate, and the Commissioners for HMRC will not make routine use of its powers to accept claims made outside these limits.”

In other words, HMRC is unlikely to accept your form if you submit it after the deadline.

HMRC can make an exception if you submitted the form late for reasons beyond your company’s control. For example, the person responsible for the form was ill.

However, as exceptions are made on a case-by-case basis, it’s prudent to assume HMRC will reject your form, and you won’t be able to make a claim.

What information do I need to submit in the claim notification form?

You will need to submit the following information on the claim notification form:

- Your company’s Unique Taxpayer Reference (UTR)

- The name of the main internal R&D contact that’s responsible for your R&D claim

- The contact details of any agent involved in your R&D Tax claim, such as an R&D Tax Relief consultant

- The start and end date of the accounting period you’re claiming for

- A high-level summary of your planned activities

You don’t need to include evidence to prove these activities met the definition of qualifying R&D on your form. However, you will need to in the additional information form (AIF) when you submit your claim.

Who can submit the claim notification form?

The following people can submit a claim notification form on behalf of your company:

- A representative of that company

- An agent acting on the company’s behalf

Get help from our R&D Tax Relief experts

Looking for help preparing and submitting the claim notification form? Or wondering what to do if you’ve missed the submission deadline?

GrantTree’s R&D Tax Relief experts are here to help. With more than 14 years of experience filing compliant claims and over £400 million secured for our clients, our team are perfectly placed to help you navigate this important scheme.

Just get in touch, and one of our team will be right with you.