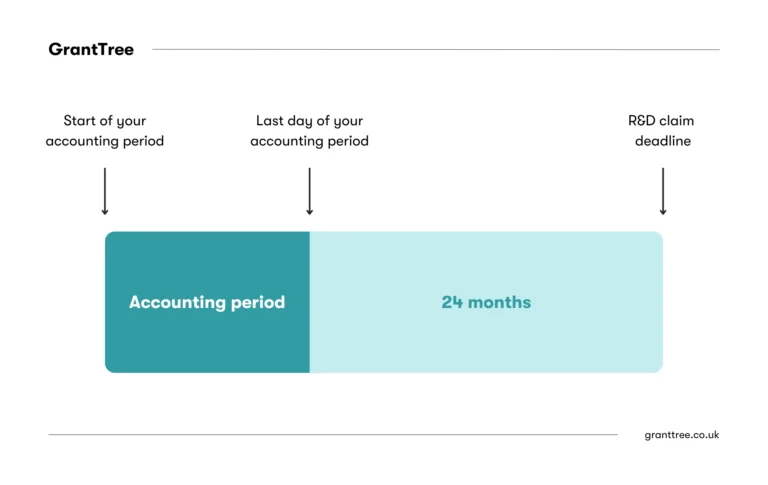

The R&D claim deadline (i.e. the deadline for claiming R&D Tax Relief) is two years after the end of the accounting period in which your development work took place.

So, if your accounting period ended on 31 December 2023, you have until 31 December 2025 to submit your R&D Tax claim.

The R&D claim deadline applies to the new R&D expenditure credit (RDEC) or ‘merged’ scheme and enhanced R&D intensive support (ERIS).

It also applies to the old SME R&D Tax Relief and RDEC schemes, which apply to accounting periods starting before 1 April 2024.

However, if you haven’t applied for R&D Tax Relief before or in any of the last three years, you will need to submit a claim notification form.

The deadline for this is six months after the end of your accounting period. That’s 18 months before the R&D claim deadline.

You must file the claim notification form before you file for R&D Tax Relief.

If you’re coming up to the deadline and need help making sure you file in time, our R&D Tax specialists are here to support you.

What happens if I miss the R&D claim deadline?

HMRC deals with late claims in accordance with its Statement of Practice 5 (2001).

In most cases, if you miss the claim deadline, you won’t be able to claim R&D Tax Relief on the relevant work. This could cost you a lot of funding.

However, HMRC understands that sometimes companies are unable to file their claims for reasons outside of their control.

Exceptional reasons for missing an HMRC deadline

- You and your agents (your accountants, R&D Tax Credits specialists, etc) were unaware of profits that you could claim relief on when the deadline passed

- The amount of a profit or loss depended on discussions with an HMRC inspector which were not complete when the deadline passed, and the delay in agreeing the profit/loss is not substantially your fault or the fault of your agents

Acceptable 'features'

- An officer of your company was ill or otherwise absent for a good reason

- The absence or illness arose at a critical time and prevented the making of a claim within the normal time limit

- There was good reason why your claim was not made before the time of the absence or illness

- There was no other person who could have made your claim within the normal time limit

Can I claim R&D Tax Relief after filing my tax return?

You can file an R&D Tax Relief claim even if you’ve already filed your corporate tax return for the accounting period in which your development work took place.

You will need to amend your CT600 for the accounting period. Your company will also need to submit an additional information form (AIF).

The AIF is now mandatory for all companies claiming R&D Tax Relief.

In it, you need to provide a range of technical and financial information about your projects to prove they are eligible for relief.

Claim notification form - the new deadline for R&D tax claims

In an effort to clamp down on non-compliant filings, the government has introduced a new claim notification form.

You will need to submit this form if your company:

- Hasn’t claimed R&D Tax Relief before

- Has claimed before but not in the last three years

The deadline for the claim notification form is six months after the end of your accounting period.

As with R&D Tax claims, HMRC will only accept claim notification forms submitted after the deadline in exceptional circumstances.

Learn more about these circumstances and the claim notification form generally.

Worried about missing the R&D claim deadline?

Are you approaching the deadline for claiming R&D tax relief? GrantTree has you covered.

Through our highly efficient R&D Tax Relief service, we can prepare a fully compliant claim before the deadline, ensuring you receive your full funding allowance.

Our team has 14 years of experience preparing R&D Tax claims, unlocking more than £400 million for some of the UK’s most ambitious businesses.

To get started on your claim, just get in touch.