GrantTree principal technical consultant Dr Razia Chowdhry explains how technical expertise can help you maximise your R&D Tax Credits claim and avoid trouble with HMRC.

If you’ve been browsing GrantTree’s website – and our ‘about us’ page, in particular – you may have noticed a few of us at the company have the job title ‘R&D Technical Consultant’ or ‘Principle R&D Consultants’.

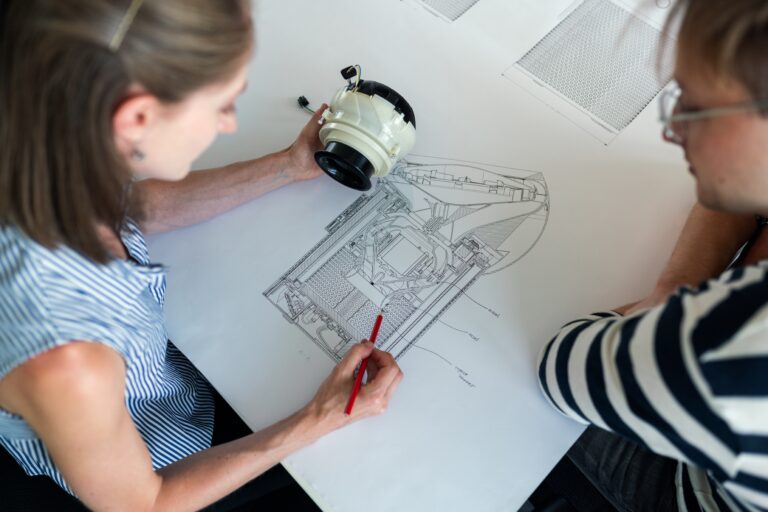

Technical consultants are members of the team that, like me, use our scientific and technological experience to help our R&D Tax Credits clients to translate their complex research and development projects into language HMRC’s tax inspectors can understand.

Now you may be wondering why your development work needs ‘translating’. And where this ‘translation’ actually takes place. In this blog, I’m going to try and clear up these important points and generally explain how an R&D technical consultant can add value to your R&D Tax Credits claim.

I’ll be covering a fair amount of ground. So feel free to skip ahead to the summary section for the TL;DR.

Why is technical experience important for R&D Tax Credits?

When judging whether a project is eligible for R&D Tax Credits, HMRC’s tax inspectors look at whether it the government’s definition of R&D for tax purposes.

Suffice it to say, it’s hard to follow, much less apply to complex technical work.

Nevertheless, this is precisely the challenge HMRC’s tax inspectors face–applying a finicky regulatory framework to advanced research and development projects to determine whether they warrant large amounts of government funding.

This being HMRC, where clarity is king, if a tax inspector isn’t sure whether your project qualifies for R&D Tax Credits, they are liable to launch a compliance check against your company.

Compliance checks, which are commonly called enquiries, are lengthy investigations designed to discover whether your filing meets all of the agency’s criteria.

Even if your filing is 100% compliant, facing an enquiry could delay your R&D Tax Credits by several months or even years. And that’s after it has embroiled your senior finance and technical people in arduous back-and-forths with HM Revenue & Customs. If it isn’t compliant, the consequences can be far more severe.

So, long story short, enquiries are bad news for your business. So it’s a good idea to do what you can to avoid them.

That’s where an R&D technical consultant’s ability to translate scientific and technological jargon into layman’s terms starts to add value.

Lost and found in translation

One of a technical consultant’s most important jobs is to explain their clients’ research and development projects in a language HMRC’s tax inspectors will understand.

This helps your inspector apply the R&D framework to your project without the need for clarifications or time-consuming investigations.

Accessibly deconstructing abstruse development work is a real skill—one that can take years, and many R&D Tax Credits filings, to hone.

Additionally, and perhaps more importantly, it also requires a deep understanding of science and technology. This is why many of our technical consultants have PhDs in scientific fields.

But unpacking development work isn’t the only thing a trained R&D technical consultant will do. They will also explain how your work qualifies for R&D Tax Credits by comparing it to HMRC’s criteria. For example, they will highlight what advancements your projects were seeking and what uncertainties you encountered along the way.

Going these extra miles not only reduces your chances of facing an HMRC enquiry, it can also save your technical team hours of unneeded extra work.

As most companies will appreciate, a technical team’s time is a sacred resource, one that is best invested in enhancing or creating products and services.

This is why recouping a few days worth of technical capacity by using a single R&D consultant is usually a smart move.

So, how do R&D technical consultants communicate with HMRC?

When I talk about technical consultants explaining and demonstrating things to HMRC, I’m referring to the work we put into preparing our clients’ technical reports. Our technical reports answer the six questions in the technical section of the additional information form, which is now mandatory for all claimants.

If written well, your technical report will prove to HMRC that your projects satisfy the government’s definition of qualifying R&D and anticipate any doubts your inspector might have about your work.

Your technical report must be written from a technical perspective, not the point of view of a manager or marketer. So it shouldn’t discuss considerations like customer research or aesthetic choices designed to boost demand.

It must accurately explain what advance you were seeking and what uncertainties you encountered, using the official definition of these terms to make your case.

For this and many other reasons, technical narratives are best written by someone with a scientific or technological background.

Unfortunately, many businesses choose to sign this job over to their accountant, a member of their internal finance team, or a non-technical R&D Tax Credits provider instead.

This usually leads to a far less compelling and technically-sound report, increasing their chances of an enquiry.

Your enquiry defenders

Technical experience can also play an essential role if HMRC launches an enquiry against your claim.

When facing an enquiry, the key is to answer HMRC’s queries as quickly and completely as possible. Doing this well can speed up the enquiry process by reducing the chances the agency will come back looking for more information.

An R&D technical consultant can be of a lot of help, here. Using our technical and tax credit experience, GrantTree’s Enquiry Defence Team can deconstruct HMRC’s questions, identify what information they’re looking for, and provide it in that same, accessible way I outline above.

Additionally, if HMRC wants to conduct a live interview with members of your finance and development teams, as is common during compliance checks, GrantTree’s technical can teach you how to answer the inspector’s questions, explaining what data and details will be relevant to the call.

This extra counsel can be particularly useful if your tax inspector summons HMRC’s DevOps team, the CDIO, to deepen their interrogation of your technology.

In summary

- GrantTree’s R&D technical consultants are scientists and engineers that add value to your R&D Tax Credits claim

- They do this by explaining how your research and development work qualifies for the R&D Tax Relief scheme to HMRC

- This explanation takes place in the technical section of your additional information form

- Filing a clear, well-written technical report answering the key questions in your additional information form significantly reduces your chances of facing an HMRC enquiry

- Writing a compelling technical report takes practice and a strong technical background, like those possessed by GrantTree’s technical consultants

- Using a technical consultant also protects the time of your technical team, enabling them to focus on additional development work

- If you do face an HMRC enquiry, a technical consultant can expedite the process by quickly supplying the agency with the information they’re after

Strengthen your next claim with technical expertise

If you have any questions about GrantTree’s R&D Tax Credits service or would like extra technical support on your claim, just get in touch.

Our R&D Tax Credits experts are standing by to help!