National lockdowns and new console releases fuel mammoth surge in software and hardware sales. But small studios struggle to capitalize.

Sales of video games and accessories in the UK jumped by an unprecedented 30% last year, as stuck-at-home consumers doubled down on digital entertainment.

According to the UK Games Industry Market Valuation 2020, a new report from leading industry group UKIE, the overall games industry generated a record £7 billion in revenue in 2020, thanks to a combination of national lockdowns and the release of new Playstation and Xbox consoles.

Software sales including downloads and streamed games were 18% higher than in 2019. Spending on controllers, PC components, and other hardware soared by 60%.

Spending on cultural products like collectables and soundtracks rose more than 30% year over year, despite a 97% collapse in revenues from live events.

Debuted on the opening day of the London Games Festival, UKIE’s report concluded that “homebound consumers turned to games for entertainment and as a way to virtually connect with friends and families.”

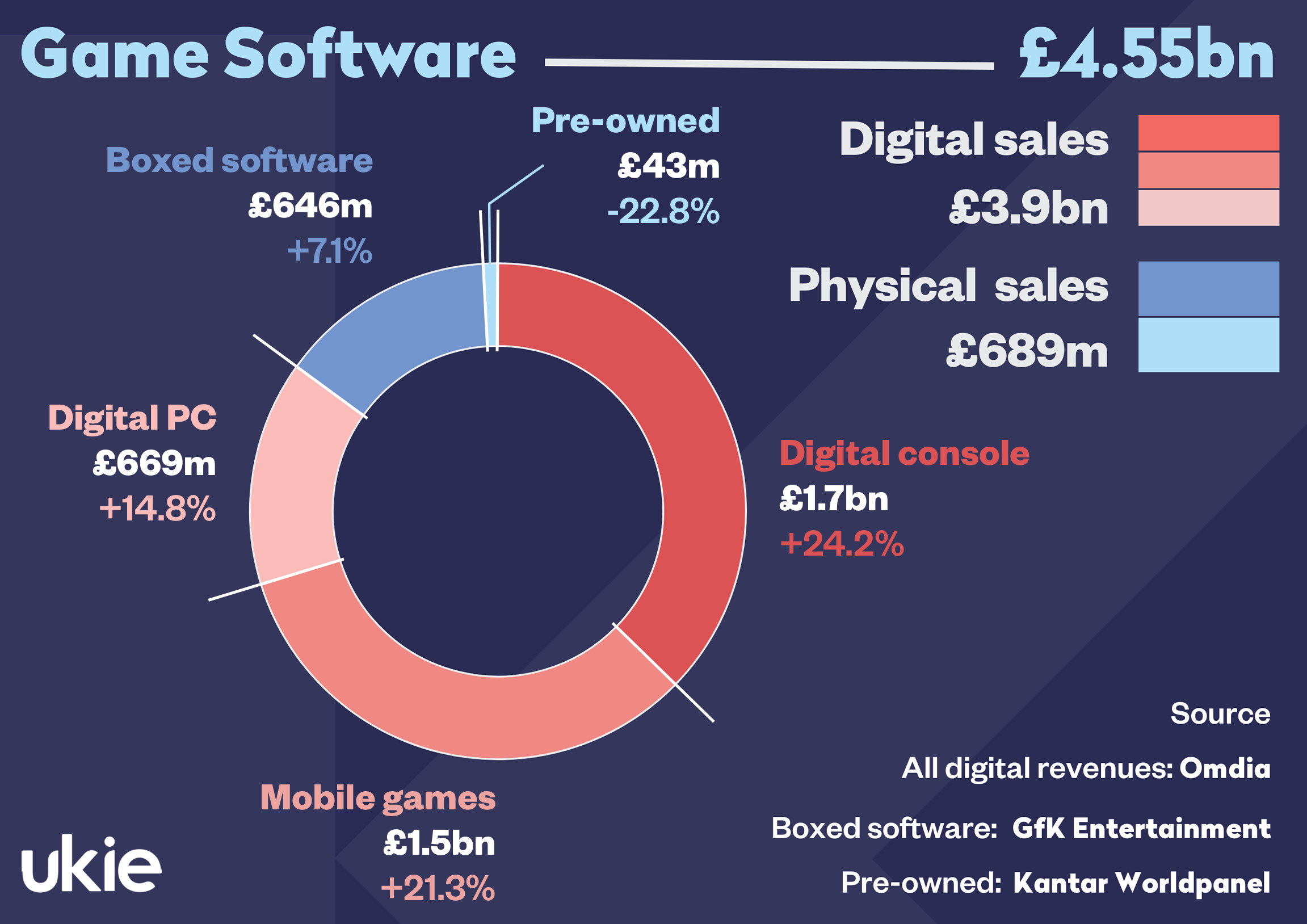

Digital sales dominate software spending

Digital games sales dominated software spending, with 85p of every £1 going to virtual games and app stores, according to analysis from research firm Omida.

In-console purchases accounted for more than a third of the £4.5 billion spent on software. Spending on mobile games reached £1.5 billion; a 20% increase year-on-year.

Despite severe restrictions on high street shopping, figures from GfK entertainment found that spending on box software, including physical copies of games, climbed more than 7% to nearly £650 million.

However, national and regional lockdowns did have a significant impact on the market for pre-owned games, which fell 23% last year, due to its dependence on brick-and-mortar chains like CEX.

While digital downloads grew on all platforms, GfK found that Nintendo Switch was the big winner of last year’s March lockdown, with sales on the versatile console tripling compared to the previous quarter.

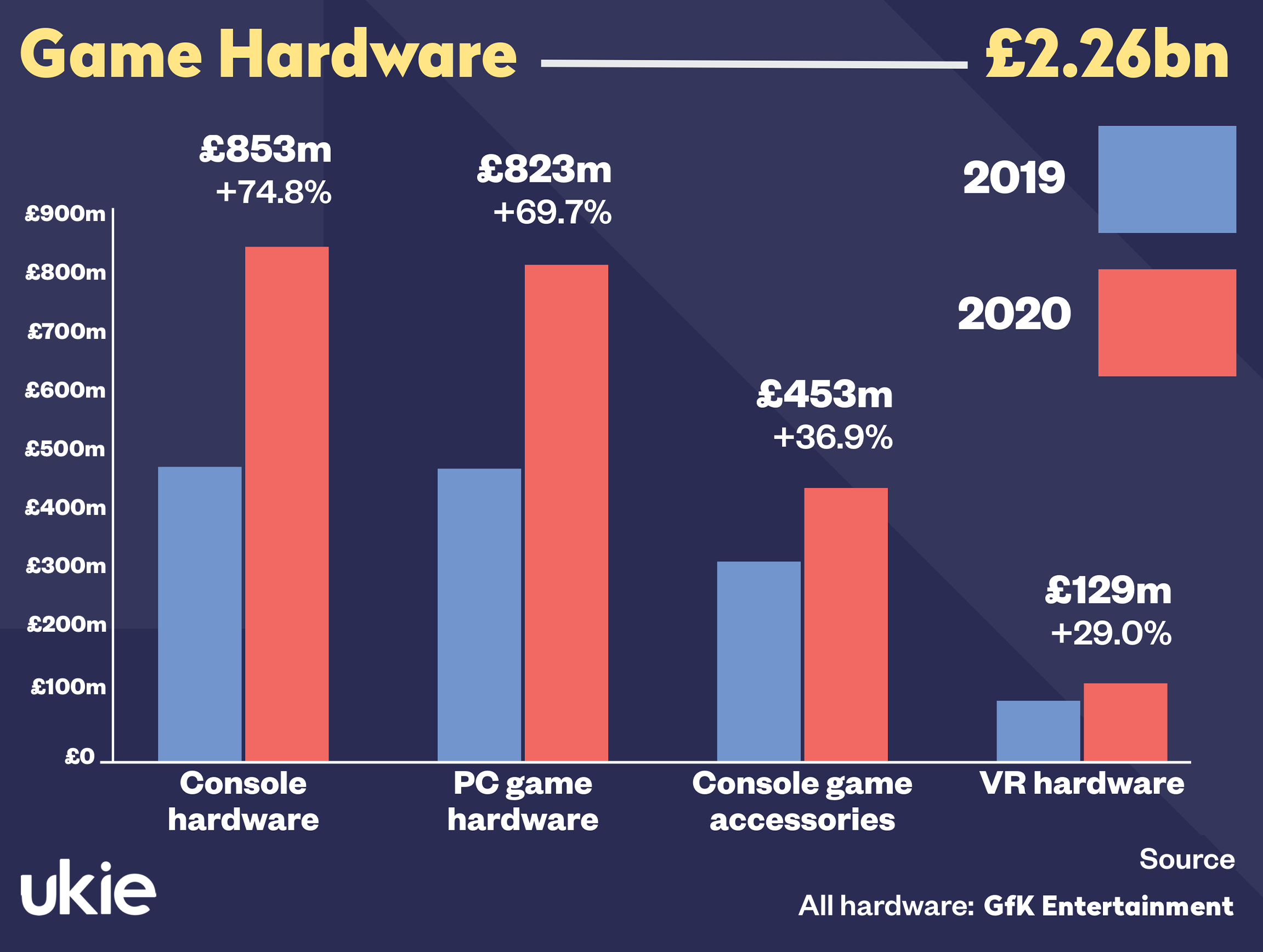

A new high for hardware

Revenues from console sales exceeded £850 million in 2020; a 74.8% increase in 2019. Nintendo Switch was the most popular console, though demand for XBOX One and PlayStation 4 systems also climbed sharply.

According to Dorian Bloch at GfK entertainment, the PS5 and Xbox Series launches also had “a marked effect on the huge jump in overall hardware revenues.”

Sales of PC hardware, including screens and graphics cards, also rose steeply to £823 million. However, some of this increase was driven by consumers upgrading their home offices rather than investing in games-specific equipment.

Consumers spent a further £600 million on console accessories and VR equipment, according to UKIE’s report.

Smaller studios struggle to capitalize

The UK Games Industry Market Valuation is the latest in a series of good news stories for the UK’s thriving games industry.

Britain’s gaming sector has been going from strength to strength for some years now, with an increasing number of consumers adding video games to their entertainment and social repertoire. Covid has accelerated this change, but it is not the route cause.

To meet this demand, UK games developers are investing, hiring and growing faster than ever before.

According to trade association TIGA, UK studios added more than 3000 new jobs between November 2018 and April 2020. They also invested almost £1 billion in new games and staff; £200 million more than in the previous period.

But while things look rosy for the industry as a whole, many smaller studios are still struggling to raise the funding needed to capitalise on the soaring demand for games.

Of the 1,041 studios the UK, almost three-quarters are ‘micro-studios’, meaning they employ less than five full-time staff. And over the last decade, 40% of all British studios have been forced to close, often because of financial hardship.

These figures detail the true scale of the funding gap in the UK video games industry, and the continued importance of government support. Especially through Video Games Tax Relief.

Keep up to date

To learn more about the funding options available to your studio, sign up to GrantTree’s newsletter.