Business Leaders Face Personal Risk from New R&D Tax Requirements

All companies must now list an individual responsible for their claim, with worrying implications for business leaders.

All companies must now list an individual responsible for their claim, with worrying implications for business leaders.

The main things you need to know about the Research and Development expenditure credit (RDEC).

If you’ve just finished your financial year and are planning to apply for R&D Tax Relief, there’s something you need to know.

GrantTree answers your pressing questions about the upcoming reforms to R&D Tax Relief, including the merger of the SME and RDEC schemes.

HMRC has provided details of new measures it is taking to tackle non-compliant R&D Tax claims and failure rates for new requirements.

Everything you need to know about one of the most significant changes in the history of R&D Tax Relief.

Everything you need to know about the changes to the R&D Tax Relief scheme that will take place in 2023.

Head of R&D Tax Relief Sam Aiken shares the biggest revelations from this year’s R&D Tax Relief report, published by HMRC.

HMRC’s revelation points to a troubling lack of understanding among applicants and substandard counsel from R&D Tax providers.

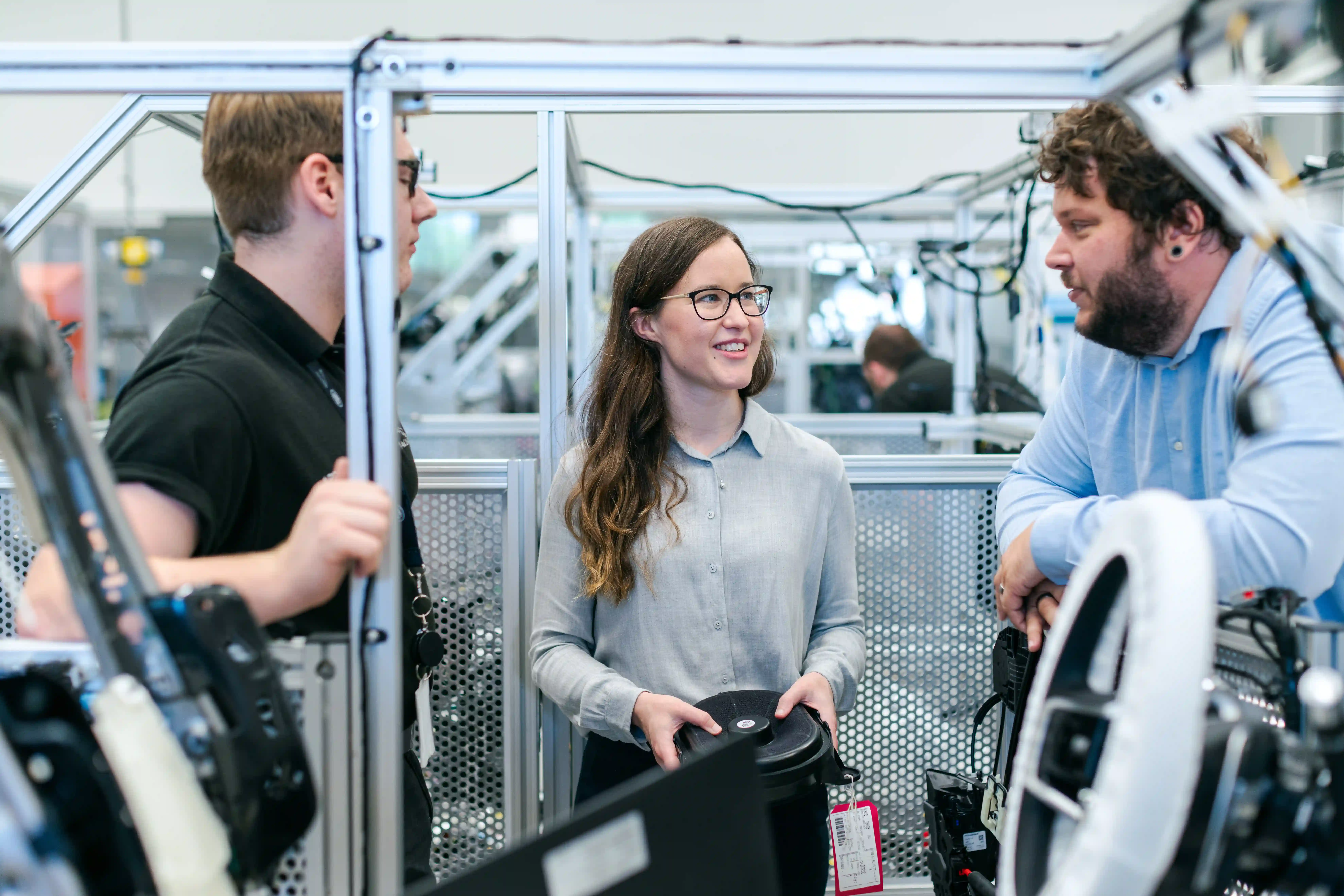

Sector-specific technical experts can help you maximise your R&D Tax Credits claim and steer you away from trouble with HMRC. Here’s how.

Keep up to date with all things GrantTree. You will receive a newsletter once a month containing tailored news, insights and white papers.

We are GrantTree. And we are here to make innovating easier. Our specialists will connect you with the funding you need so you can focus on growing your business.

© Copyright. GrantTree. CN 07403467. VAT GB 101974824. All Rights Reserved.