HMRC Reveals New Compliance Measures for R&D Tax Claims

HMRC has provided details of new measures it is taking to tackle non-compliant R&D Tax claims and failure rates for new requirements.

Our latest insights on government, debt, equity funding, and UK innovation.

HMRC has provided details of new measures it is taking to tackle non-compliant R&D Tax claims and failure rates for new requirements.

Everything you need to know about one of the most significant changes in the history of R&D Tax Relief.

Everything you need to know about the changes to the R&D Tax Relief scheme that will take place in 2023.

Head of R&D Tax Relief Sam Aiken shares the biggest revelations from this year’s R&D Tax Relief report, published by HMRC.

HMRC’s revelation points to a troubling lack of understanding among applicants and substandard counsel from R&D Tax providers.

Round 3 of the Future Economy Investor Partnership SME competition is offering up to £1.4 million in grant funding plus investor support to innovative companies.

Sector-specific technical experts can help you maximise your R&D Tax Credits claim and steer you away from trouble with HMRC. Here’s how.

Helping your clients claim R&D Tax Relief? Partnering with a specialist like GrantTree could unlock a host of benefits for you and your customers.

In this Specialist Spotlight, we talk to life sciences specialist Razia Chowdry about her role at GrantTree and her cutting-edge research into synthetic cells.

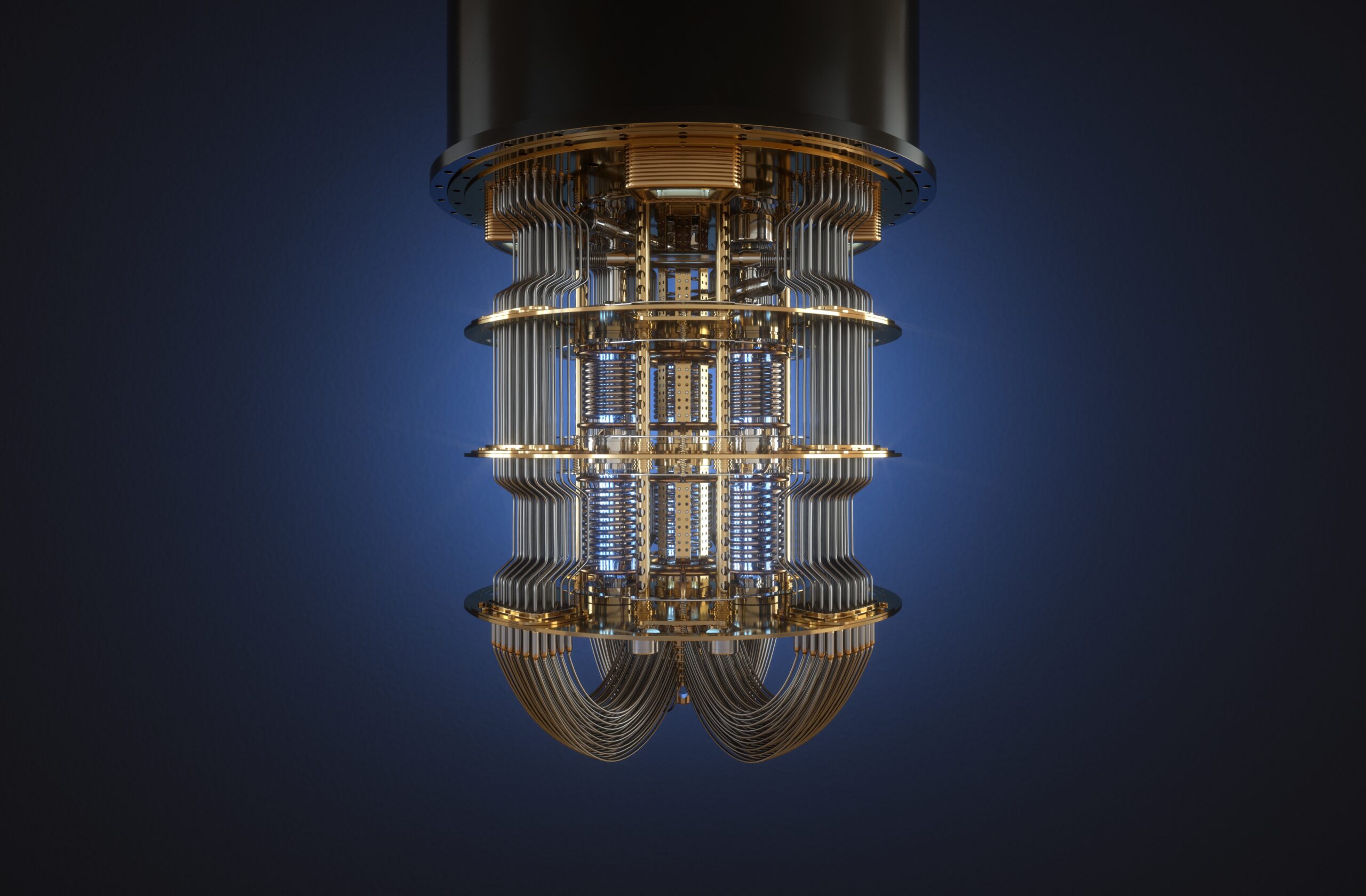

If you are working on a technology in the quantum networking space, you could secure up to £2 million in grant funding from a new competition from the Small Business Research Initiative (SBRI).

The involvement of new tax units has dramatically increased HMRC’s capacity to launch enquiries into R&D Tax claims.

Companies will soon have to submit much more information about their development work to access R&D Tax Relief. Here’s what you need to know.

Who’s eligible and how to apply for Round 6 of the Faraday Battery Challenge. Grants of up to £1.75 million available.

Which costs qualify for R&D Tax Credits? Read GrantTree’s comprehensive guide to working out which of your costs qualify and how much you should claim for

Working on an innovative hydrogen production project? Then you could win up to £20 million in grant funding from the Net Zero Hydrogen Fund.

Recent round’s 95.6% rejection rate emphasises the value of expertise from innovation funding consultant like GrantTree.

HMRC sent nudge letters to over 2,000 R&D Tax Relief claimants in January as the agency expands its clampdown on fraudulent submissions.

GrantTree helps three innovative businesses access transformative funding from highly competitive scheme. GrantTree helped three companies secure over £1 million in grant funding from the

Looking for funding for a game-changing research and development project? You may be eligible for up to £1.4 million in grant funding through the January

HMRC sent nudge letters to over 2,000 R&D Tax Relief claimants in January as the agency expands its clampdown on fraudulent submissions.

The SME R&D Tax Credits and enhanced R&D intensive support schemes let you surrender your losses in exchange for a cash credit. But should you?

R&D Tax Relief is a generous scheme that gives you back up to 33% of your development costs as a reduction to your corporation tax

HMRC has specific rules on claiming R&D Tax Relief for subcontractors and subcontracted R&D. Here’s what you need to know.

If your company has strong financial ties to other businesses, you may be classified as a linked or partner enterprise. This could have a significant

SME R&D Tax Relief is a government incentive scheme providing UK startups and scaleups with billions of funding. Here’s everything you need to know about

Are you working towards your December year-end? GrantTree could help you access your R&D Tax Credit as early as next month. ‘Tis the season’, as

The significant increase in the RDEC rate will make R&D Tax Relief much more lucrative for companies that win innovation grants. On 17 November, the

Here’s what the upcoming R&D expenditure credit (RDEC) increase means for your next R&D Tax Relief claim. On 17 November, the government announced it was

HMRC’s more thorough approach means companies cannot afford to take compliance for granted. Since the start of the tax year, we have seen a marked

Chancellor Jeremy Hunt has just announced significant changes to SME R&D Tax Relief and the Research and Development expenditure credit (RDEC). Here’s what you need