What Would a Labour Government Mean for R&D Tax Relief?

With Labour way ahead in the polls, GrantTree examines what a Kier Starmer administration would mean for the future of R&D Tax Relief.

Our latest insights on government, debt, equity funding, and UK innovation.

With Labour way ahead in the polls, GrantTree examines what a Kier Starmer administration would mean for the future of R&D Tax Relief.

GrantTree has been shortlisted for a prestigious Tolley’s Taxation Award in the Best Independent Tax Consultancy category.

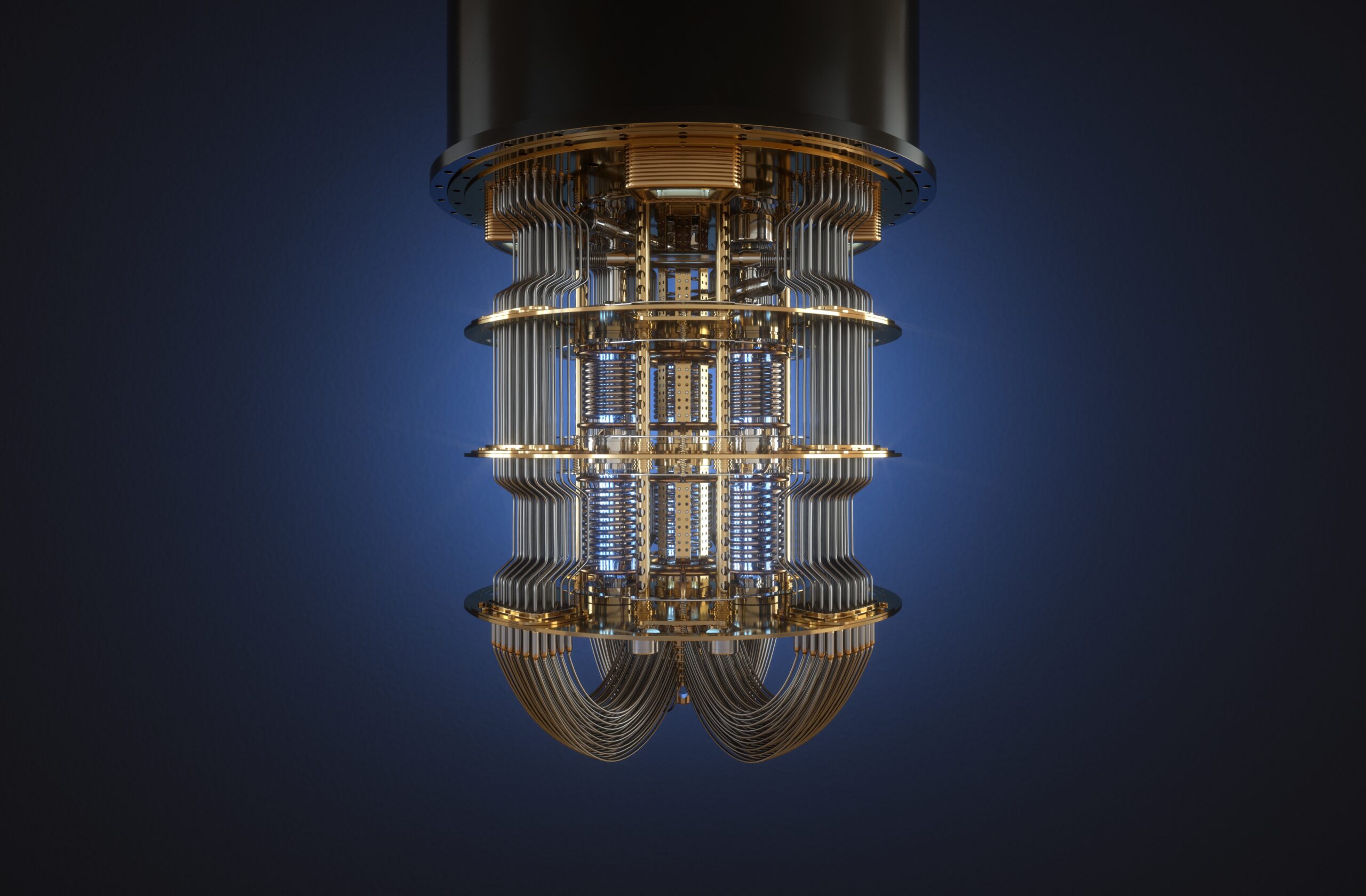

Innovate UK is offering up to £500,000 in grant funding for industrial research projects in quantum technology.

Grants of up to £70,000 for feasibility projects helping the UK materials and manufacturing space achieve net zero.

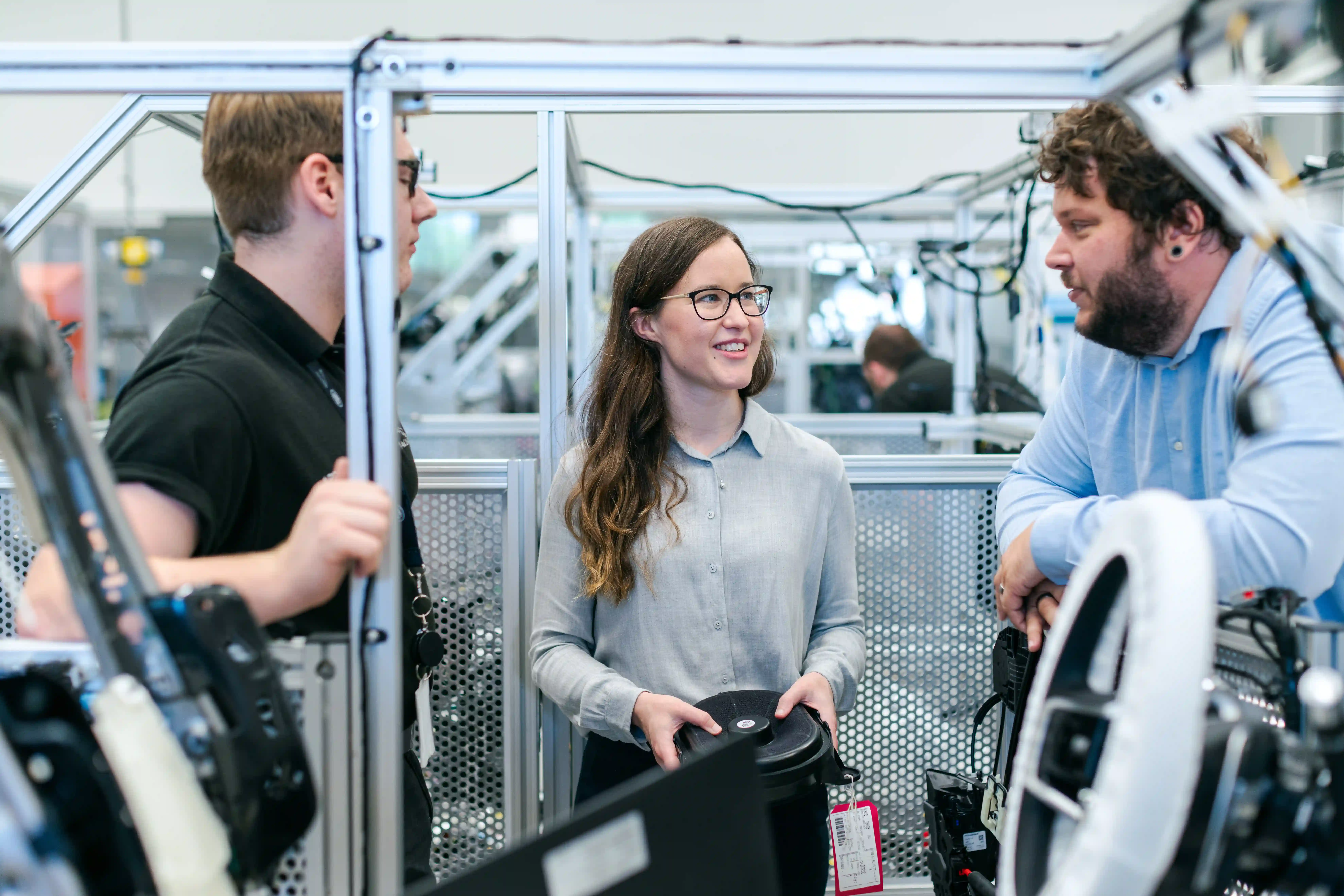

ARMD3 is offering grants of up to £1.5 million for projects that accelerate the UK automotive sector’s transition to net zero.

R&D Technical Consultant Dr. Oliver Gould, PhD shares tips for claiming R&D Tax Relief in the natural sciences field.

GrantTree CEO Nicky Johnson summarises the key takeaways from the 2024 Spring Budget for UK innovators.

A new House of Commons report reveals the extent of HMRC’s compliance crackdown.

R&D Advance Funding helps ambitious pre-revenue businesses clear financial bottlenecks and bridge funding rounds to accelerate growth.

All companies must now list an individual responsible for their claim, with worrying implications for business leaders.

The main things you need to know about the Research and Development expenditure credit (RDEC).

A complete breakdown of everything you need to do once you’ve won a grant from Innovate UK.

The Creative Catalyst competition is offering grants of up to £50,000 and a package of tailored support to small creative businesses.

We talk to Dr Emma Elvidge about her research in Antarctica and her role as an R&D Technical Consultant.

Companies can apply for up to £175,000 in grant funding to develop innovative food products that support sustained health and well-being.

The Environmental Monitoring Innovation competition is offering up to £315,000 for improved monitoring of environmental variables.

If you’ve just finished your financial year and are planning to apply for R&D Tax Relief, there’s something you need to know.

GrantTree answers your pressing questions about the upcoming reforms to R&D Tax Relief, including the merger of the SME and RDEC schemes.

HMRC has provided details of new measures it is taking to tackle non-compliant R&D Tax claims and failure rates for new requirements.

Everything you need to know about one of the most significant changes in the history of R&D Tax Relief.

Working on a cutting-edge life sciences project? You could secure up to £2 million through Innovate UK’s Biomedical Catalyst 2023 Round 2 competition.

Everything you need to know about the changes to the R&D Tax Relief scheme that will take place in 2023.

Head of R&D Tax Relief Sam Aiken shares the biggest revelations from this year’s R&D Tax Relief report, published by HMRC.

HMRC’s revelation points to a troubling lack of understanding among applicants and substandard counsel from R&D Tax providers.

Round 3 of the Future Economy Investor Partnership SME competition is offering up to £1.4 million in grant funding plus investor support to innovative companies.

Sector-specific technical experts can help you maximise your R&D Tax Credits claim and steer you away from trouble with HMRC. Here’s how.

Helping your clients claim R&D Tax Relief? Partnering with a specialist like GrantTree could unlock a host of benefits for you and your customers.

In this Specialist Spotlight, we talk to life sciences specialist Razia Chowdry about her role at GrantTree and her cutting-edge research into synthetic cells.

If you are working on a technology in the quantum networking space, you could secure up to £2 million in grant funding from a new competition from the Small Business Research Initiative (SBRI).

The involvement of new tax units has dramatically increased HMRC’s capacity to launch enquiries into R&D Tax claims.

Keep up to date with all things GrantTree. You will receive a newsletter once a month containing tailored news, insights and white papers.

We are GrantTree. And we are here to make innovating easier. Our specialists will connect you with the funding you need so you can focus on growing your business.

© Copyright. GrantTree. CN 07403467. VAT GB 101974824. All Rights Reserved.